Quicken Essentials for Mac 2010: A Positive Word

Monday, March 1, 2010 at 11:37AM

Monday, March 1, 2010 at 11:37AM  Yes, I'm in the 80%.

Yes, I'm in the 80%.

Last week, Intuit released the first version of Quicken for the Mac in about three and a half years (Quicken 2007 was released in Fall 2006). It's new name is Quicken Essentials for Mac. It does have a "2010" designation, but this is downplayed appearing nowhere in the program itself. The only place I can see it is in the top right corner of the retail box.

Let me say up front that Quicken on the Mac was the first step in changing my financial life. Keeping up with one's checking account takes discipline, and in the early years of our marriage, Kathy and I weren't all that disciplined. We did not regularly balance the checkbook. Actually, that's an understatement. I usually had very little to do with it anyhow, but I can remember times when we would try to catch up on months of statements at a time. And one time it got so bad that we had to start a new account and let the old account die. I'm not proud of any of that, but my hunch is that some of you are guilty of no less.

All of that changed in 2002 when I got a new Mac that came with Quicken installed. Keeping track of one's checking and savings accounts is not all that exciting to me. I'm not even an overly organized person by nature, but I try really hard to be. But there's something about doing things on the computer that appeals to me. If I were faced with manually reconciling my accounts every month by hand like in the old days, we might still be in a financial mess. But if I can do it on the computer—no problem.

And that's where Quicken really helped me. Reconciling my accounts in Quicken is so easy that I usually have it done in 10 to 15 minutes. And get this—since using Quicken, I have not had to make an adjustment to our accounts ever. In fact, although I still correct an error here or there, I have balanced to the penny every month since I started using Quicken in 2002. That's amazing to me even now.

And yet, all is not such a rosy picture for many Quicken users on Macs. The reality is that Quicken on the Mac has never been as robust as Quicken in Windows. A friend of mine, who happened to be a heavy Quicken user, converted to the Mac last year. As I was helping him move from Windows, he was horrified at the limitations of Quicken on the Mac platform. He begrudgingly set up Parallels so that he could run Windows on his Mac—simply to keep doing the things he was used to in Quicken.

There are other reasons that Mac users show little love for Quicken and Intuit, the company that publishes it. I hear tales of versions in the nineties that scrambled users' financial data when they upgraded. I don't know all the details—especially because my eyes will glaze over at some point when discussions about finances become too involved—but Quicken on the Mac has never been able to do all the things with investments, stocks and the like that is possible in Windows. Some banks that allowed Quicken for Windows users to download transactions wouldn't allow Mac users to do the same thing.

Now, hear me carefully—I'm not downplaying any of the issues that people have who are sore at Intuit over the lousy state of Quicken on the Mac. If any of those issues had affected me, I'm sure I'd be sore, too. But evidently, I'm in part of the 80% of basic use that Intuit has addressed in the new version for the Mac. Thus the name, "Quicken Essentials for Mac."

Evidently, 80% of Quicken users simply use it like I do for keeping track of accounts, connecting to one's bank for cleared transactions and the like. Right now if a Mac user is heavily dependent upon Quicken for online bill pay, investment tracking, and exporting their data to TurboTax, they will still want to use Quicken 2007 (or a Windows version through Bootcamp, Parallels, or VMFusion) until at least next year when hopefully the new version will have more of these features. The promise in ongoing releases is toward parity with the Windows version, but in the decision to rebuild Quicken from the ground up, Intuit decided they could either release an "essential" version this year or wait until next year with a more full-featured version. I think they made the right decision, but Intuit has used up so much of their good will in the Mac community that whatever they would have done would have been criticized. It's going to take a long time for Intuit to get back in good graces with many Mac users.

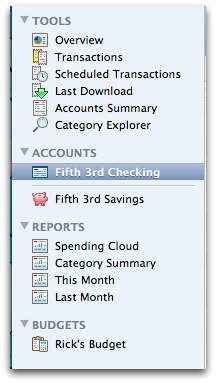

Personally, I believe they're on the right track. I don't actually think any software program needs a yearly update, but Mac users were sore when they kept seeing new versions for Windows, but we were stuck with Quicken 2007 (released in 2006) on their computers. Quicken 2007 was a program designed for PowerPC processors instead of Intel processors which have been in new Macs since 2006. Intel-based Macs can run PowerPC programs through an emulation layer called Rosetta, but it can create a drag on one's computer so generally it's to be avoided if possible. The new version of Quicken Essentials is built in Cocoa, Mac OS X's native programming environment. In fact, it's designated on the about screen as version 1.1 (Quicken 2007/Mac says it is version 16). And it looks like a modern Mac program, too. I saw one reviewer that said Quicken Essentials looked like a distant cousin of the iWork suite. It does (and I find it interesting that iWork is now setting the standards for how a Mac app should look and behave). Quicken Essentials has the standard blue narrow column on the left like iTunes or the Apple Mail app and a wider space to the right for one's data. The left column lists your accounts as well Tools (functions that Quicken can perform with your data), Reports, and a basic budget creator based upon one's spending.

The new version of Quicken Essentials is built in Cocoa, Mac OS X's native programming environment. In fact, it's designated on the about screen as version 1.1 (Quicken 2007/Mac says it is version 16). And it looks like a modern Mac program, too. I saw one reviewer that said Quicken Essentials looked like a distant cousin of the iWork suite. It does (and I find it interesting that iWork is now setting the standards for how a Mac app should look and behave). Quicken Essentials has the standard blue narrow column on the left like iTunes or the Apple Mail app and a wider space to the right for one's data. The left column lists your accounts as well Tools (functions that Quicken can perform with your data), Reports, and a basic budget creator based upon one's spending.

I've spent a few days using it. I paid bills with it Saturday and reconciled my checking and savings accounts. I've downloaded cleared transactions from my bank. I was able to do all of this even without having to set up my banking information again because Quicken Essentials did a more than adequate job of converting my Quicken 2007/Mac data over. The new Quicken Essentials will also do something that no previous version could do: it will convert Quicken for Windows data as well as data from the now defunct Microsoft Money. Previously a person moving from Windows to the Mac could convert their data over, but it was a tedious manual process requiring multiple steps.

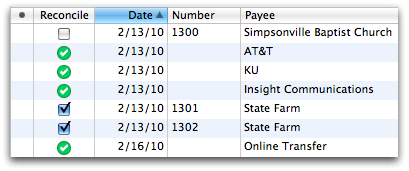

Since Quicken Essentials has been built from the ground up, it feels very much like a 1.0 program which it essentially is. There are even a few things that it won't do yet that I was used to in the previous version. For instance, on Saturday, I tried to transfer money between savings and checking accounts. In Quicken 2007, I could set this up from Quicken as an online transaction. Quicken would then connect to my bank, transfer the money in my accounts, and then record the transactions in both accounts on my computer. If this is still possible, I couldn't figure out how to do it. I finally went to my bank's website, made the transactions there, and then recorded it into Quicken Essentials myself. There are little things that are different as well. By default check numbers weren't listed in my registry and I had to turn these on. In previous versions a "C" appeared by transactions that had cleared my bank and an "R" beside transactions after I had reconciled that period in my account. Now its a check on a radio button if it's cleared and a green check if it's reconciled. I'm used to that now, but it was not immediately apparent.

There are little things that are different as well. By default check numbers weren't listed in my registry and I had to turn these on. In previous versions a "C" appeared by transactions that had cleared my bank and an "R" beside transactions after I had reconciled that period in my account. Now its a check on a radio button if it's cleared and a green check if it's reconciled. I'm used to that now, but it was not immediately apparent.

Many things are just handled differently such as one row of data per transactions instead of two in previous versions. This means that I cannot as easily place Quicken on the left and my monthly budget spreadsheet in Numbers on the right. Quicken Essentials simply takes up more horizontal space and there's nothing that can be done to change that. Also, in previous versions of Quicken, when I connected to my bank to download cleared transactions, I was met with a window listing all of these items allowing me to accept or reject them. Quicken Essentials gives me no such window of information. It automatically matches the cleared transactions to a transaction I've previously recorded in my registry adding a blue dot in one column. The problem with this? Well, 99% of the time, Quicken matches my transactions correctly, but occasionally, it's not correct. Now I cannot reject a matched transaction and will have to give my registry extra scrutiny to make certain everything is done correctly.

Also, in previous versions of Quicken, when I connected to my bank to download cleared transactions, I was met with a window listing all of these items allowing me to accept or reject them. Quicken Essentials gives me no such window of information. It automatically matches the cleared transactions to a transaction I've previously recorded in my registry adding a blue dot in one column. The problem with this? Well, 99% of the time, Quicken matches my transactions correctly, but occasionally, it's not correct. Now I cannot reject a matched transaction and will have to give my registry extra scrutiny to make certain everything is done correctly.

Essentially (pun intended) however, I have the same functionality (for my purposes) in Quicken Essentials for Mac that I had in Quicken 2007. I like the new interface overall, and I'm pleased to see that Intuit has started over and promised to do things right, regardless of how painful the process has been for them and they're customers. In spite of a few things lacking, I'm pleased to be using this new version and I look forward to improvements and added features as Intuit continues to develop the program.

Financial,

Financial,  Quicken,

Quicken,  reviews in

reviews in  Technology

Technology