Quicken Essentials for Mac 2010: A Positive Word

Monday, March 1, 2010 at 11:37AM

Monday, March 1, 2010 at 11:37AM  Yes, I'm in the 80%.

Yes, I'm in the 80%.

Last week, Intuit released the first version of Quicken for the Mac in about three and a half years (Quicken 2007 was released in Fall 2006). It's new name is Quicken Essentials for Mac. It does have a "2010" designation, but this is downplayed appearing nowhere in the program itself. The only place I can see it is in the top right corner of the retail box.

Let me say up front that Quicken on the Mac was the first step in changing my financial life. Keeping up with one's checking account takes discipline, and in the early years of our marriage, Kathy and I weren't all that disciplined. We did not regularly balance the checkbook. Actually, that's an understatement. I usually had very little to do with it anyhow, but I can remember times when we would try to catch up on months of statements at a time. And one time it got so bad that we had to start a new account and let the old account die. I'm not proud of any of that, but my hunch is that some of you are guilty of no less.

All of that changed in 2002 when I got a new Mac that came with Quicken installed. Keeping track of one's checking and savings accounts is not all that exciting to me. I'm not even an overly organized person by nature, but I try really hard to be. But there's something about doing things on the computer that appeals to me. If I were faced with manually reconciling my accounts every month by hand like in the old days, we might still be in a financial mess. But if I can do it on the computer—no problem.

And that's where Quicken really helped me. Reconciling my accounts in Quicken is so easy that I usually have it done in 10 to 15 minutes. And get this—since using Quicken, I have not had to make an adjustment to our accounts ever. In fact, although I still correct an error here or there, I have balanced to the penny every month since I started using Quicken in 2002. That's amazing to me even now.

And yet, all is not such a rosy picture for many Quicken users on Macs. The reality is that Quicken on the Mac has never been as robust as Quicken in Windows. A friend of mine, who happened to be a heavy Quicken user, converted to the Mac last year. As I was helping him move from Windows, he was horrified at the limitations of Quicken on the Mac platform. He begrudgingly set up Parallels so that he could run Windows on his Mac—simply to keep doing the things he was used to in Quicken.

There are other reasons that Mac users show little love for Quicken and Intuit, the company that publishes it. I hear tales of versions in the nineties that scrambled users' financial data when they upgraded. I don't know all the details—especially because my eyes will glaze over at some point when discussions about finances become too involved—but Quicken on the Mac has never been able to do all the things with investments, stocks and the like that is possible in Windows. Some banks that allowed Quicken for Windows users to download transactions wouldn't allow Mac users to do the same thing.

Now, hear me carefully—I'm not downplaying any of the issues that people have who are sore at Intuit over the lousy state of Quicken on the Mac. If any of those issues had affected me, I'm sure I'd be sore, too. But evidently, I'm in part of the 80% of basic use that Intuit has addressed in the new version for the Mac. Thus the name, "Quicken Essentials for Mac."

Evidently, 80% of Quicken users simply use it like I do for keeping track of accounts, connecting to one's bank for cleared transactions and the like. Right now if a Mac user is heavily dependent upon Quicken for online bill pay, investment tracking, and exporting their data to TurboTax, they will still want to use Quicken 2007 (or a Windows version through Bootcamp, Parallels, or VMFusion) until at least next year when hopefully the new version will have more of these features. The promise in ongoing releases is toward parity with the Windows version, but in the decision to rebuild Quicken from the ground up, Intuit decided they could either release an "essential" version this year or wait until next year with a more full-featured version. I think they made the right decision, but Intuit has used up so much of their good will in the Mac community that whatever they would have done would have been criticized. It's going to take a long time for Intuit to get back in good graces with many Mac users.

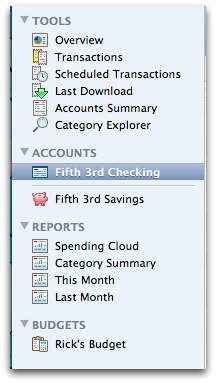

Personally, I believe they're on the right track. I don't actually think any software program needs a yearly update, but Mac users were sore when they kept seeing new versions for Windows, but we were stuck with Quicken 2007 (released in 2006) on their computers. Quicken 2007 was a program designed for PowerPC processors instead of Intel processors which have been in new Macs since 2006. Intel-based Macs can run PowerPC programs through an emulation layer called Rosetta, but it can create a drag on one's computer so generally it's to be avoided if possible. The new version of Quicken Essentials is built in Cocoa, Mac OS X's native programming environment. In fact, it's designated on the about screen as version 1.1 (Quicken 2007/Mac says it is version 16). And it looks like a modern Mac program, too. I saw one reviewer that said Quicken Essentials looked like a distant cousin of the iWork suite. It does (and I find it interesting that iWork is now setting the standards for how a Mac app should look and behave). Quicken Essentials has the standard blue narrow column on the left like iTunes or the Apple Mail app and a wider space to the right for one's data. The left column lists your accounts as well Tools (functions that Quicken can perform with your data), Reports, and a basic budget creator based upon one's spending.

The new version of Quicken Essentials is built in Cocoa, Mac OS X's native programming environment. In fact, it's designated on the about screen as version 1.1 (Quicken 2007/Mac says it is version 16). And it looks like a modern Mac program, too. I saw one reviewer that said Quicken Essentials looked like a distant cousin of the iWork suite. It does (and I find it interesting that iWork is now setting the standards for how a Mac app should look and behave). Quicken Essentials has the standard blue narrow column on the left like iTunes or the Apple Mail app and a wider space to the right for one's data. The left column lists your accounts as well Tools (functions that Quicken can perform with your data), Reports, and a basic budget creator based upon one's spending.

I've spent a few days using it. I paid bills with it Saturday and reconciled my checking and savings accounts. I've downloaded cleared transactions from my bank. I was able to do all of this even without having to set up my banking information again because Quicken Essentials did a more than adequate job of converting my Quicken 2007/Mac data over. The new Quicken Essentials will also do something that no previous version could do: it will convert Quicken for Windows data as well as data from the now defunct Microsoft Money. Previously a person moving from Windows to the Mac could convert their data over, but it was a tedious manual process requiring multiple steps.

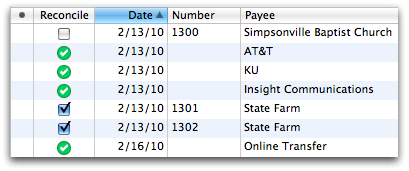

Since Quicken Essentials has been built from the ground up, it feels very much like a 1.0 program which it essentially is. There are even a few things that it won't do yet that I was used to in the previous version. For instance, on Saturday, I tried to transfer money between savings and checking accounts. In Quicken 2007, I could set this up from Quicken as an online transaction. Quicken would then connect to my bank, transfer the money in my accounts, and then record the transactions in both accounts on my computer. If this is still possible, I couldn't figure out how to do it. I finally went to my bank's website, made the transactions there, and then recorded it into Quicken Essentials myself. There are little things that are different as well. By default check numbers weren't listed in my registry and I had to turn these on. In previous versions a "C" appeared by transactions that had cleared my bank and an "R" beside transactions after I had reconciled that period in my account. Now its a check on a radio button if it's cleared and a green check if it's reconciled. I'm used to that now, but it was not immediately apparent.

There are little things that are different as well. By default check numbers weren't listed in my registry and I had to turn these on. In previous versions a "C" appeared by transactions that had cleared my bank and an "R" beside transactions after I had reconciled that period in my account. Now its a check on a radio button if it's cleared and a green check if it's reconciled. I'm used to that now, but it was not immediately apparent.

Many things are just handled differently such as one row of data per transactions instead of two in previous versions. This means that I cannot as easily place Quicken on the left and my monthly budget spreadsheet in Numbers on the right. Quicken Essentials simply takes up more horizontal space and there's nothing that can be done to change that. Also, in previous versions of Quicken, when I connected to my bank to download cleared transactions, I was met with a window listing all of these items allowing me to accept or reject them. Quicken Essentials gives me no such window of information. It automatically matches the cleared transactions to a transaction I've previously recorded in my registry adding a blue dot in one column. The problem with this? Well, 99% of the time, Quicken matches my transactions correctly, but occasionally, it's not correct. Now I cannot reject a matched transaction and will have to give my registry extra scrutiny to make certain everything is done correctly.

Also, in previous versions of Quicken, when I connected to my bank to download cleared transactions, I was met with a window listing all of these items allowing me to accept or reject them. Quicken Essentials gives me no such window of information. It automatically matches the cleared transactions to a transaction I've previously recorded in my registry adding a blue dot in one column. The problem with this? Well, 99% of the time, Quicken matches my transactions correctly, but occasionally, it's not correct. Now I cannot reject a matched transaction and will have to give my registry extra scrutiny to make certain everything is done correctly.

Essentially (pun intended) however, I have the same functionality (for my purposes) in Quicken Essentials for Mac that I had in Quicken 2007. I like the new interface overall, and I'm pleased to see that Intuit has started over and promised to do things right, regardless of how painful the process has been for them and they're customers. In spite of a few things lacking, I'm pleased to be using this new version and I look forward to improvements and added features as Intuit continues to develop the program.

Financial,

Financial,  Quicken,

Quicken,  reviews in

reviews in  Technology

Technology

Reader Comments (25)

PLEASE don't give Intuit money for this worthless piece of junk application. It's bad enough that previous versions were miles behind the Windows version. Now they're cutting out even more features.

It won't track stock purchases and sales properly. No stock option tracking. And your own glowing review says that it doesn't even handle transactions properly.

Why in the world would you plug an application that doesn't even do what it's supposed to do?

PLEASE don’t give Intuit money for this worthless piece of junk application

Too late! I already did!

It’s bad enough that previous versions were miles behind the Windows version. Now they’re cutting out even more features.

Actually, they haven't cut anything. Since they've started over, it's a 1.x program. Supposedly, they'll be adding features as time goes on.

It won’t track stock purchases and sales properly. No stock option tracking.

I don't need it to. I don't have stocks or sales. This is where that 80% thing I was talking about comes in.

And your own glowing review says that it doesn’t even handle transactions properly.

Glowing review? I thought it was a fair review. I thought I covered both strengths and shortcomings. And did I say it doesn't handle transactions properly? What does that mean?

Why in the world would you plug an application that doesn’t even do what it’s supposed to do?

Well, that's the thing. One of my points is that it's essentially doing everything I need it to do. Maybe by the time v. 2/2011 rolls around, I'll have some stocks in something that needs tracking.

This program also has limited capability to import your data from older versions of Quicken. If banks still allow me to download data in .qif format why can't Quicken allow me to import my old data from pre-2007 versions of Quicken. I agree with Joe. Until they fix this problem I do not plan to upgrade. Buyer beware.

Dave, According to the Quicken website, you can import from the Mac versions of Quicken 2005, 2006, and 2007. And I've heard elsewhere that earlier versions might work, but they're not making guarantees. I can tell you that the conversion of my 4310 transactions from Quicken 2007 was quick and painless. I spent a good bit of time looking everything over and have found no discrepancies.

"This means that I cannot as easily place Quicken on the left and my monthly budget spreadsheet in Numbers on the right. Quicken Essentials simply takes up more horizontal space and there’s nothing that can be done to change that."

C'mon now Rick we both know that dual 30" ACD's will gladly fix this problem for you. Like most issues, it's all a matter of perspective and finding the right solution. :)

Thanks for the fair review. I think I'm going to try iBank before the new version of Quicken, but I'll keep it in mind.

Yes, twice the screen real estate of my 15" MacBook Pro would surely do the trick. But considering I paid bills in a hotel lobby on Saturday, I'd hate to think about tossing that 30" screen in my messenger bag!

For what it's worth, I hear VERY good things about iBank. And I like the fact that they have an iPhone app. I'm hoping that one day Pocket Quicken--which I used to run on my Palm--will make its way to the iPhone.

I have the new QEM and while I do like the interface better and the speed is appreciated as well some of the missing reports are what I will have the most problems with. If there is a way to compare last year and this year spending I have not been able to find it. It probably is able to be done manually but that kind of defeats the purpose for me.

I went out and bought QEM today. I've had Quicken for Windows 10 years ago and virtually all the Mac versions since then. The Windows version was the only one i ever used seriously since limitations on the Mac version were maddening. I was hoping that two major timesavers had been dealt with in QEM and thankfully, they were. The first was automatic transaction downloads from Bank of America. The Windows version has had this for eons. Quicken 2007 and previous versions relied on downloading files and importation...a major pain in the butt. QEM 2010 finally gets this right with the nation's largest bank.

Second, previous Mac Quickens never did categorization to my liking. First, it should know many common names & types of stores out of the box so I wouldn't have to do every silly task. Categorizing a laundry list of transactions every week is a tedious process that Quicken 2007 couldn't remember after I did it once. QEM knew all the local grocery stores and allowed me to see what I was spending on food in under 5 minutes of downloading and running a report.

I don't have stocks outside of mutual funds and I use BofA for check payments so I don't quite need QEM to do these just yet (I'm an 80%'er). The interface is clean and modern....way better than the crusty old Quicken 2007 interface that dated back to the OS 8/9 days. It's not perfect but anyone who uses the Finder and iTunes will understand it.

I understand the vitriol toward Intuit for its incomprehensible Mac policy over the years (especially under Bill Campbell's leadership). But this is the first Quicken I've seen that looks like it has a future. Next stop is getting the old features of Quicken 2007 back in the product and eventually (dare I say it?) feature parity with Windows. I can't recommend it to family and friends who have been using Quicken for Mac forever until then. But for me, the new features are enough of a time saver for me that it does make it worth $70 to me. I can use this.

This review does not state whether one can write checks on the computer, and print the checks with an attached printer.

This review does not state whether one can order checks for your printer from Intuit/Quicken.

This review states you cannot do bill pay, but does not define bill pay. For example, do you mean that one cannot go online to your bank, pay a utility or other bills, then have Quicken Essentials log onto your bank to get this info and import it? If that is what you mean, please say so clearly and plainly.

Thank you.

Dan, I looked into Quicken's checks years ago and thought they were too expensive. I've never used that feature. Quicken Essentials does not print checks to my knowledge. I would guess this feature is out of the 80%, too :-)

Maybe for folks who want to print checks, this feature will be implemented in a future version.

I did not mean the kind of bill pay you describe. I can also do bill pay from my bank's website and those transactions will, of course, download into Quicken Essentials. What one cannot do is set up the bill pay transactions in Quicken Essentials and then send those instructions to the bank. I think I tried doing this in Quicken 2005 years ago, but I've not tried it since. It was just something I never needed. Most of the time if I can pay a bill online, I simply go to the payee's website and then manually record it in Quicken. I've done that for years. It works for me, and that's what I did Saturday when I paid bills with Quicken Essentials.

Let's see what the 80% equates to - in your mind, and apparently Quicken's:

1. Doesn't use the system to write checks.

2. Doesn't track investments

3. Doesn't use bill pay

4. Doesn't care if the system properly tracks cleared transactions.

5. No interest in stock options.

6. No need to share a data file with other versions.

Yeah, I guess if you fall into those categories, then maybe QEM makes sense. OTOH, if you're in those categories, simply using your checkbook register would be just as good - or any of the free programs.

What they've done to the Mac version is a travesty - and it's really amazing that anyone is defending it at all.

QEM 2010 does not print checks. Again, whether somebody uses QEM depends on their needs. I don't print checks, I don't track individual stocks (right now) and most importantly, although I'm an old Quicken for Mac user, I've never been a consistent user mainly because using the product was so difficult for me. QEM is probably best for new users that haven't used a financial product before or haven't used one religiously. For them (and myself), the product is pretty clean, obvious in design and easily deconstructs what can be a painfully boring topic (personal finances).

For experienced users or Windows switchers, the new interface and extra bank institutions are welcome but it doesn't make up for the lack of stock tracking, missing reports, lack of BillPay, check printing and other features. For example, a couple of people I know whom I help with Mac support have been using Quicken for over a decade. They are older and still print hard checks with Quicken. That feature will have to be there before I ever recommend that they upgrade.

That being said, QEM isn't burdened by the old Quicken 2007 code base that literally dates back to the 1990s. It's was one of the last major applications still written in Carbon without an Intel version (meaning they never made the transition to Xcode like everyone else). Would it have been better if they had started this new code base three years ago? Absolutely. If that had happened, we would have had a full featured modern Quicken right now. But better late than never. The new code base should be much easier to add features to and should be easier to debug and maintain.

If QEM 2010 isn't enough for you, sit tight. The framework is in place for a lot better Quicken Deluxe product down the road. The old product's architecture could never match the Windows version. With some extra work, this one certainly could.

@Joe, I think we can agree that Mac users have been sorely neglected by Intuit. I do disagree with two of your points however. You've said above that the system doesn't properly track cleared transactions. You made a similar point earlier, but I'm not clear whether you're talking about the same thing each time or not.

IF you're talking about my comment about downloading cleared transactions not always matching, I was referring to my experience in earlier versions of Quicken (2002-2007). As I said, it worked most of the time, but occasionally it wasn't correct—almost always resulting from transactions with same amounts and similar or same entrees in the payee field. That's not necessarily a criticism as I understand how this could happen. I merely mentioned that in the new version of Quicken Essentials, there's not a window for me to see all the transactions and accept them or reject them. As of this morning, I've downloaded cleared transactions three times, and it's been right with every amount so far. That includes downloading 17 cleared transactions this morning that matched up perfectly with everything I'd previously entered.

I also disagree with your assertion that "OTOH, if you’re in those categories, simply using your checkbook register would be just as good." Maybe you were merely being hyperbolic, but obviously this is not true as I described from my own experience using Quicken over the last eight years. As I said, because of Quicken, I've been able to keep up with my finances in an unparalleled manner resulting in balancing to the penny every month since I started using it in 2002.

I use Quicken to keep track of my accounts (letting Quicken do all the math for me), reconciling my accounts monthly which is made extremely easy, and for connecting to my bank daily to see what transactions had cleared. None of this could be done so easily with a simple checkbook register. If this were the case no one would have ever started using Quicken to begin with.

As I said in the post, people would have criticized Intuit no matter what route they took. If they had waited to release a more full-featured product next year, people would have complained about the wait. If they go ahead and release a basic version this year, people still complain as you are prime example.

You claim I'm defending them; I'm not. But I am trying to be reasonable. Again, we would both agree that Intuit has made its own bed of disharmony with Mac users. But what would you have them do at this point?

The aborted Quicken Financial Life for Mac was a nightmare. I downloaded a beta of it, and it was clearly the wrong direction. I still don't know why a person would want coverflow for their finances (although I notice that iBank has this feature, too). With almost unanimous critical reaction, Intuit made a surprising move by pulling the plug on Quicken Financial Life for Mac and starting completely over. So they were delayed yet again.

So, really, Joe, with the state of the way things are, here in 2010, would you have preferred that they release nothing this year and wait for a full featured version in 2011 or release something right now, which based upon surveys of users would target the majority of the way users run Quicken now?

My positive word about the program is that (1) the program drops legacy code and has started over in Cocoa, (2) provides primarily the same functionality that I and a lot of other users have experienced in the past, and (3) I'm hopeful about future direction.

And one last thing... I didn't mention it in the post, but I'm very optimistic about Aaron Patzer's involvement in all this. He created a terrific product in Mint.com, and now that he's been placed as head of Quicken, we finally see some real movement for the Mac.

@Sevenfeet said it best in his comment:

If QEM 2010 isn’t enough for you, sit tight. The framework is in place for a lot better Quicken Deluxe product down the road. The old product’s architecture could never match the Windows version. With some extra work, this one certainly could.

I think the pros outweigh the cons for me on this one. Just paid for QEM and set it up. Nice job on the interface. It's as smooth as iWork, iLife, etc IMHO.

I'm in the 80% as well. I use Quicken 2005 which amazingly enough has worked flawlessly through multiple Mac computer and OS X software upgrades. It does what I want it to do and does it well.

I know it's time to upgrade though. I figure QEM is my last chance to get my data converted directly by the new program.

I'm going to upgrade and hope many others do as well. Intuit has taken a big step with massive management changes. Mac market share is steadily rising as well. With a solid base of QEM users and profit from the sale of QEM, the new team at Intuit will be given the best reasons to start creating much better software for the Mac platform.

I have to agree with R. Mansfield on most of this. I like the new Quicken Essentials much better then Quicken 2007. I am one of the 80% that does not use the features that are missing from this version, so I think the pros really overcome the cons. I had some serious gripes about Quicken 2007, and searched for something better and almost went away from Quicken altogether. I tried iBank and almost went with it instead of Quicken but found some very serious flaws in that program. So I always found myself going back to quicken but was unsatisfied, until now.

Here are just a few things I disliked about Quicken 2007:

1. Every time I load the program my register was so tiny it only showed about three transactions and I had to resize it to make it useable every single time I opened the program.

2. It had the silly bar going across the top of my screen covering other things while I was using quicken. I know this was something that could be removed but I like to have some sort of panel for features, but I would rather have it in the same window with the register.

3. The searching ability was pathetic in Quicken 2007. I could click find and type in something but it would only take me to one transaction that matched the search criteria at a time. So if I want to see all items with that criteria I would have to go through the ridiculous reports and try to customize it to show me what I want to see. With Quicken Essentials its so easy and so Mac-like. if I want to quickly see all transactions to Speedway for instance I can do so very easily. Or if I want to quickly show only deposits or only payments I can do that.

4. You could not pick and choose what fields to show or rearrange them. In Quicken Essentials I can easily choose what fields that I want showing and what order they show up in.

One thing I disagree with R. Mansfield on is when he said that you cannot reject a matched transaction. This is not true. You simply right click on the downloaded transaction and choose Reject Automatic Transaction Match.

Overall for what I use a check register program for Quicken Essentials is way better then Quicken 2007. I guess if I used all the other features then I might be upset as well but still would not be able to deny the far superior points of Quicken Essentials. I too am excited about them starting from scratch and to see what is in store in the next few years.

Thanks for pointing out the way to reject matched transactions. I had not discovered that yet.

Wait for a little while before getting IBank. Some things are incredibly hard to do, but I think it will improve, as they have had lots of feedback from users (or ex-users).

Do you by any chance have a step-by-step instruction on reconciling? I can't seem to get a handle on it and anything I've found just seems to tell me where it is in the menu. I've also used Quicken for years and it has also helped me get a hold of my finances. I really don't want to return this version, but if I can't get a handle on how this one works I'll be forced to return to Mac 2007.

Kimmi, the Reconcile function is in the transaction menu. It works essentially the same as Quicken 2007 with the exception is that I can't find any command to automatically uncheck cleared transactions. One thing I've always liked to do when reconciling my account in Quicken is to uncheck everything and start from scratch comparing it against my statement. When I've checked everything and the difference is 0 (zero), I know I've done it correctly.

Let me know if you have any specific questions before this. I assume you were able to reconcile correctly in Quicken 2007, right?

Yes, I've reconciled in Quicken 2007, which might be why I can't get my head wrapped around how the 2010 works. For example, I'm not sure how to check things off. If I hold down the option key it gives the green reconciled check mark, but I'm not sure if I'm supposed to do that. Last month I checked them off that way and ended up with a huge negative number, so I unchecked them all by hand and then went back thru while comparing them to my statement manually. Also, the negative/positive number doesn't make sense in how it corresponds with what I check off. For example, this month everything seems to be the same as my statement but I still have a negative number...

I guess I'm just trying to figure out the proper way to check off my transactions.

Really, I am reconciling my accounts in the new Quicken the same way as I did in the old one. I choose Reconcile from the Transactions menu. I enter in my starting amount and ending amount based on my statement.

Since I connect to my bank daily, most of my transactions are usually already checked. The old version of Quicken allowed you to uncheck all the transactions between the beginning and ending dates, but I haven't found a quick way to do that. Regardless, I can uncheck everything in less than sixty seconds.

Then, I simply start comparing what's in my Quicken registry to my bank statement. I just check off the items in Quicken one by one. You don't have to hold down an option key. Just click on it with the mouse. Sometimes some of the transactions are outside of the starting and ending dates, but this isn't a big deal either. Just check them off as you come to them.

I've balanced to the penny with Quicken since I began using it in 2002, and that includes using Quicken essentials every month since it was released.

I have Mac 10.5.8 and Quicken 2005. I have used Quicken for at least 15 years. I use it to track all my accounts, budget, and print checks. What I have not done, but really want to do, is take advantage of automatic transaction-entering from my banks, investment accounts and credit card accounts, in order to eliminate the manual in-putting I have done for years but which has become too counterproductive and time consuming.

Also, and most importantly, I have an iphone, and want to be able to enter and manage my quicken account when I am on the go traveling, or just shopping. I am very open to other platforms if I can convert from Quicken (I would even consider starting anew and just keeping Quicken on my desk top for history)... Who can give me the best suggestion? With appreciation, Brenda

I want to shoot this application right in the face. Usually reconciliation goes fine, but if there are any issues there is absolutely no way to bulk unclear/clear transactions. Frustrating as [censored]. Intuit is a pile of [censored].

nsj, sorry I had to edit your comment. This blog content and its commentors must be rated G when it comes to use of language. Nevertheless, I appreciate your sentiment. It's been a while since I wrote this post. And there has not been a significant update to Quicken on the Mac since (beyond the occasional point updates). That's nearly four years between major updates, which is probably a record for Intuit. I've come close to simply using the Windows version, but I do so hate to do that!